If you’re looking for the perfect checking account for you and your significant other, there are a few things you should consider before choosing the right one. While some banks offer joint accounts that allow easy management for couples, others may offer individual accounts with shared access, making it easier to handle finances individually while still having a shared account for bills and other expenses.

When looking for a checking account for couples, it's important to consider factors such as fees, interest rates, access to online banking, and customer support. Finding a bank that offers a competitive interest rate can help you earn a little extra on your deposits, while having access to online banking and customer support can make managing your finances easier and hassle-free.

Are you tired of keeping track of multiple accounts for different expenses? Do you want to simplify your finances? Are you looking for a checking account that can help you and your significant other manage your money better? If you answered yes to any of these questions, then finding the right checking account for couples may be the solution you’ve been looking for. Keep these factors in mind and choose an account that fits your unique needs to make managing your finances as a couple a breeze.

10 Best Checking Accounts For Couples

| # | Product Image | Product Name | Product Notes | Check Price |

|---|---|---|---|---|

|

1

|

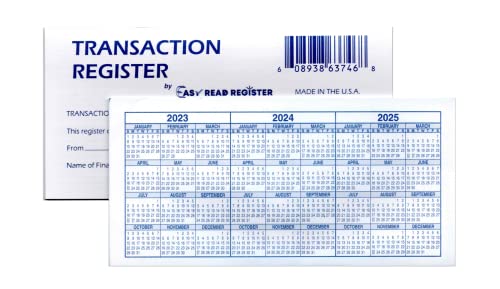

Keeping track of finances and planning ahead with calendars for 2023-2025. Made in the USA.

|

|

||

|

2

|

This product is ideal for efficiently mowing large areas of grass with precision and speed.

|

|

||

|

3

|

Product is ideal for those looking for a high-quality, affordable zero turn mower option.

|

|

||

|

4

|

Ideal for efficiently mowing large areas with tight turns and precise maneuverability, saving time and increasing productivity.

|

|

||

|

5

|

Ideal for cutting grass efficiently and comfortably with precise maneuverability, perfect for large lawns or commercial use.

|

|

||

|

6

|

It is ideal for keeping track of transactions and balances in a personal checking account.

|

|

||

|

7

|

Ideal for keeping track of personal expenses and transactions, especially during the Christmas season.

|

|

||

|

8

|

The product is ideal for tracking personal checkbook expenses during the Christmas holidays as a great stocking stuffer gift.

|

|

||

|

9

|

The product is ideal for efficiently mowing large open and flat areas with minimal maneuvering.

|

|

||

|

10

|

The product is ideal for personal checkbook organization and holiday expense tracking, making it a great stocking stuffer gift.

|

|

1. Personal Checkbook Registers, Set Of 10, 2023-2024-2025 Calendars, Made In Usa

Introducing the Checkbook Transaction Register, a must-have accessory for anyone who wants to keep track of their finances. This pack includes 10 registers, each of which has 13 pages with a total of 440 lines to ensure that you can keep track of all your transactions with ease. The registers come with calendars for 2023, 2024, and 2025, making it easier for you to plan your finances for the upcoming years.

The registers are compact and measure 6" x 3", making them easy to carry around in your purse or wallet. They are made in the USA, ensuring that you are getting a high-quality product that is built to last. With the Checkbook Transaction Register, you can easily keep track of your finances, making it easier for you to budget and plan for the future.

Whether you are a business owner or an individual, the Checkbook Transaction Register is an essential tool that can help you keep track of your finances. With its compact size, high-quality paper, and easy-to-use design, this register is the perfect way to stay on top of your finances and plan for the future. So why wait? Order your pack of Checkbook Transaction Registers today and take control of your finances!

Best Checking Accounts For Couples FAQs

Can couples have separate checking accounts in addition to a joint account?

Yes, couples can have separate checking accounts in addition to a joint account. It's actually quite common for couples to maintain separate accounts for various reasons.

One reason is to maintain financial independence and autonomy. Some couples may feel more comfortable having their own accounts to manage their own finances, rather than feeling like they have to constantly consult with their partner before making any financial decisions.

Another reason is to manage expenses more efficiently. For example, if one partner travels frequently for work, they may prefer to have their own account to cover their travel expenses without having to constantly transfer money from a joint account.

However, it's important to have open communication and transparency about finances in a relationship. Couples should establish clear guidelines for how they will manage their finances, including how much money will be contributed to the joint account and how expenses will be divided. Ultimately, the decision to have separate checking accounts is a personal one and should be based on each couple's individual financial goals and preferences.

How can couples avoid conflicts when managing their joint checking account?

Couples can avoid conflicts when managing their joint checking account by setting clear expectations and communication. Firstly, it is important to discuss and agree on financial goals and priorities. This will help to ensure that both individuals are on the same page and working towards the same objectives. Secondly, create a budget together, outlining how much money will be allocated towards bills, savings, and discretionary spending. This will help to avoid overspending or surprise expenses. Thirdly, establish a system for tracking expenses and monitoring the account balance regularly. This will help to identify any discrepancies or potential issues before they become bigger problems. Lastly, communication is key. It is important to discuss any financial concerns or disagreements openly and respectfully, and work together to find a solution that works for both parties. By following these tips, couples can manage their joint checking account successfully and avoid conflicts.

How can couples choose the best checking account to fit their needs?

Couples should consider several factors when choosing the best checking account to fit their needs. First, they should determine their banking habits and needs. For example, do they need overdraft protection, access to ATMs, or mobile banking? Second, couples should research the fees associated with each account, including monthly maintenance fees, ATM fees, and overdraft fees. They should also consider the interest rate on the account, as some checking accounts offer a higher interest rate than others. Third, couples should determine if the account offers joint ownership, which can be important if they want to share expenses and manage their finances together. Finally, couples should consider the bank's reputation and customer service, as good customer service can make managing finances much easier. By considering these factors, couples can choose a checking account that fits their needs and helps them manage their finances effectively.

How can couples monitor their account activity and expenses effectively?

One effective way for couples to monitor their account activity and expenses is to create a joint budget and regularly review it together. This will help both partners understand their financial situation and ensure that they are both on the same page when it comes to spending and saving. It's also important to establish clear communication about purchases and financial decisions. Couples should discuss their financial goals and priorities, and make sure to consult each other before making any large purchases. Keeping track of expenses through a shared spreadsheet or budgeting app can also be helpful in keeping both partners accountable and informed. Another tip is to designate specific roles and responsibilities for managing finances, such as one partner handling bills and the other handling investments. Ultimately, the key to effective account monitoring and expense management is open and honest communication, mutual trust, and a shared commitment to financial stability and success.

How can couples work together to achieve their financial goals through their checking account?

Couples can work together to achieve their financial goals through their checking account by communicating their financial priorities and creating a budget that aligns with those priorities. Both partners should have access to the account and be involved in monitoring and managing expenses. It is important to set realistic goals and track progress regularly.

To start, couples should have a clear understanding of their current financial situation. They should review their income and expenses to identify areas where they can cut back and save. From there, they can set short-term and long-term financial goals, such as paying off debt or saving for a down payment on a house.

Once goals are established, couples can create a budget that outlines how much money will be allocated towards different expenses each month. This budget should be reviewed and adjusted regularly to ensure that it is realistic and reflects any changes in income or expenses.

Finally, couples should consider using tools such as automatic transfers and online banking to make managing their checking account easier. By working together and staying committed to their financial goals, couples can achieve financial stability and security.

What are some tips for maintaining a healthy financial relationship with a partner?

Maintaining a healthy financial relationship with a partner is crucial for a successful long-term relationship. Here are some tips to keep your financial relationship healthy:

1. Open and honest communication: It’s important to have open and honest communication about your finances with your partner. Discuss your income, debts, savings, and financial goals.

2. Create a budget together: Creating a budget together can help you both understand your financial situation and stay on track with your financial goals.

3. Divide financial responsibilities: Divide financial responsibilities such as paying bills, managing investments, and handling taxes. This can help prevent conflicts and ensure that everything is taken care of.

4. Respect each other’s financial habits: Everyone has different financial habits and priorities. It’s important to respect each other’s financial habits and work together to find a compromise that works for both of you.

5. Plan for the future: Discuss your long-term financial goals together, such as saving for retirement or buying a house, and create a plan to achieve them.

Remember, communication and mutual respect are key to maintaining a healthy financial relationship with your partner.

What are the benefits of having a joint checking account for couples?

Having a joint checking account for couples can offer numerous benefits. Firstly, it promotes transparency and trust between the partners as both of them have access to the account and can monitor the financial transactions. Secondly, it helps in managing finances efficiently by combining the income and expenses of both partners in one place. This can make budgeting and bill payments easier and avoid any confusion or disputes about who pays for what. Thirdly, it can help in achieving shared financial goals such as saving for a vacation or buying a house. Fourthly, joint accounts often offer higher interest rates and lower fees compared to individual accounts. Lastly, in case of an emergency, both partners can access the funds immediately without any delay or hassle. However, it is important to establish clear communication and trust before opening a joint account and ensure that both partners are on the same page regarding financial goals and spending habits.

What are the potential drawbacks of having a joint checking account?

When it comes to managing finances, having a joint checking account can seem like a convenient option for couples or business partners. However, there are some potential drawbacks that should be considered before opening a joint account.

Firstly, joint checking accounts can make it difficult to track and manage individual expenses. When both parties have access to the account, it can be challenging to separate personal and shared expenses, leading to confusion and potential disagreements.

Secondly, joint accounts can also lead to financial vulnerability. If one account holder overspends or becomes overdrawn, both parties are equally responsible for the debt. This can be especially concerning if the account holders have different spending habits or financial goals.

Lastly, joint accounts can also make it difficult to maintain financial privacy. Both account holders have access to the account's transaction history, which can be problematic if one party wants to keep their spending private.

Overall, while joint checking accounts can offer convenience and shared financial responsibility, it's important to consider the potential drawbacks and communicate openly with the account holder before opening a joint account.

What are the responsibilities of each partner in a joint checking account?

When two individuals open a joint checking account, they both assume equal responsibility for the account. This means that both partners have equal rights to access the account, make transactions, and manage the funds. However, it is essential that both partners agree on the ground rules for using the account before opening it.

The responsibilities of each partner in a joint checking account include regular monitoring of the account balance and activity, timely deposits, and ensuring that there are sufficient funds to cover any checks written or transactions made. Both partners should also agree on the budget and the amount of money that can be spent from the account.

It is crucial for both partners to communicate openly and honestly about their spending habits, income, and financial goals. This will help ensure that both partners are on the same page and that there are no misunderstandings or disagreements about the use of the account.

In summary, the responsibilities of each partner in a joint checking account include regular monitoring of the account, timely deposits, open communication, and mutual agreement on budget and spending limits.

What types of fees should couples be aware of when opening a checking account?

When opening a checking account as a couple, it's important to be aware of the various fees that may be associated with the account. One common fee to look out for is a monthly maintenance fee, which some banks charge if certain requirements, such as maintaining a minimum balance, are not met. Overdraft fees are another consideration, as they can quickly add up if one or both partners frequently overdraw the account. Couples should also be aware of ATM fees, which can vary depending on the bank and ATM location. Additionally, some banks may charge fees for using online bill pay or for receiving paper statements. It's essential to carefully review all the fees associated with a checking account before opening one, as they can significantly impact a couple's finances. By understanding the fee structure, couples can select a checking account that best fits their needs and avoids unnecessary expenses.